Bipartisan coalition of elected officials united in opposing Cuffs Run hydro project

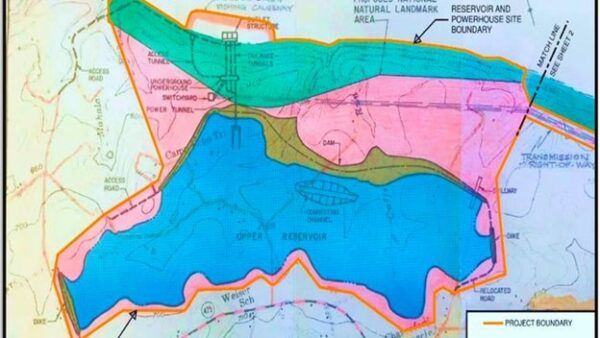

As public officials, we are accustomed to vibrant discussion and heated debate about issues impacting our communities, commonwealth, and nation. We disagree at times with our colleagues from the other side of the proverbial political aisle. We stand united, however, in strong opposition to the proposed construction of a 25-foot-high, 1.8-mile-long dam and power turbine […] [Read More]