Introduction | The Student Debt Crisis | Legislation | News | What is an Income Share Agreement? | FAQ’s | Submit Feedback

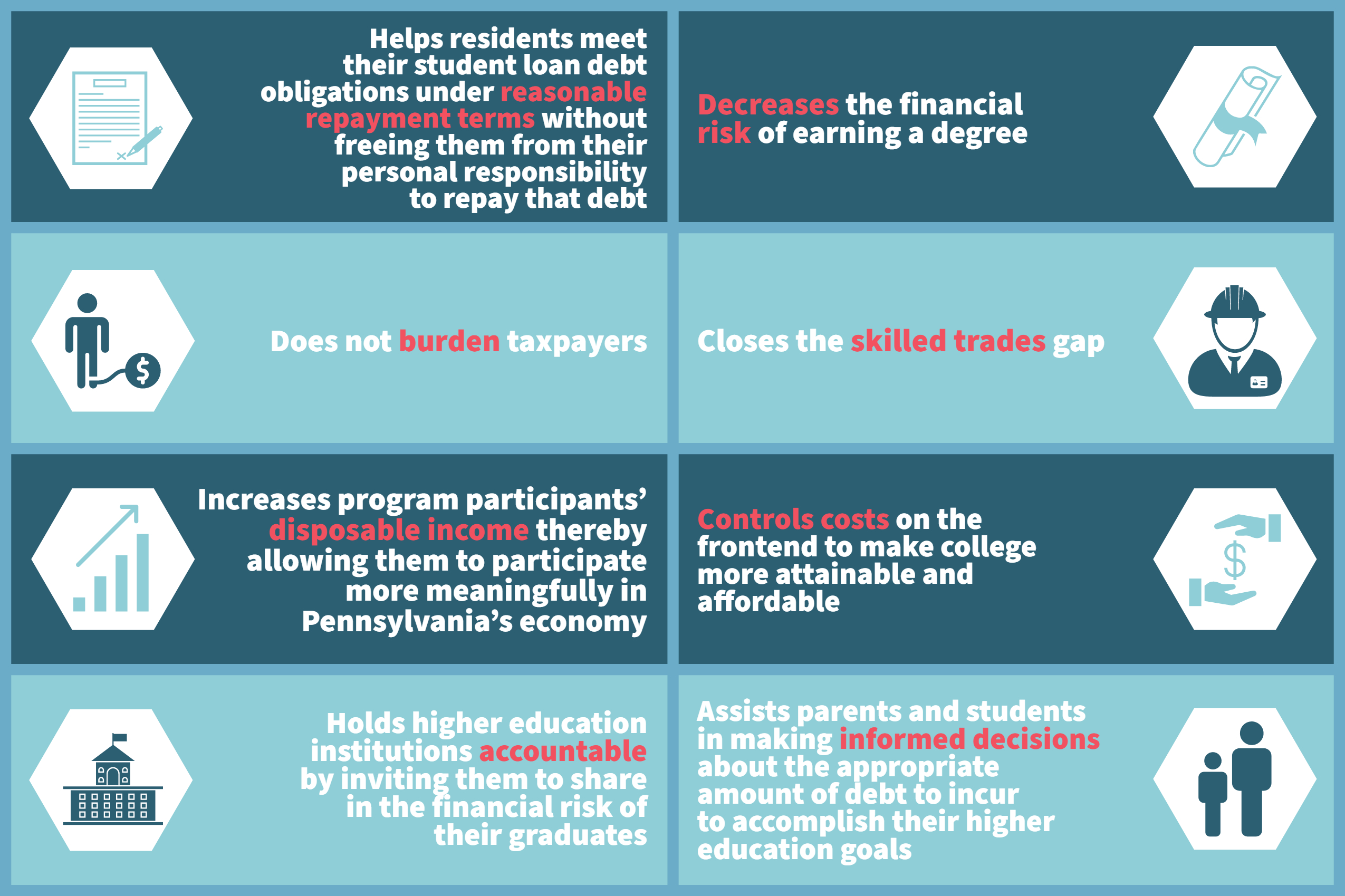

If we are to create an opportunity society in Pennsylvania where all residents can experience earned success and upward mobility, fostering (1) strong families, (2) great schools, (3) vibrant and healthy communities, and (4) free enterprise are imperative. As part of that mission, I believe that it is absolutely necessary to address the student loan debt crisis in a way that:

As such, I have introduced two bills that aim to tackle the goals outlined above. You can find detailed information about these proposals, Income Share Agreements, the student loan debt crisis, and more below.

The Student Loan Debt Crisis

Since 1969, college tuition has increased by over 3,000 percent, far outpacing the increase in the consumer price index. Yet, studies show that today’s real average wage (that is, the wage after accounting for inflation) has about the same purchasing power it did 40 years ago. This has resulted in younger generations taking on 300 percent more student loan debt than their parent’s generation; leaving long-term effects on the national economy and causing ripple effects in our communities. While many argue that students should forgo post-secondary education altogether due to the astronomical cost, the reality of our current job market is that over 65 percent of job openings through 2020 will require a college degree.

OpEd: Student Debt Crisis is a Crisis for Us All

Read the full op-ed

Additional Information on the Student Loan Debt Crisis:

11 Mind-Blowing Facts that Show Just How Dire the Student-Loan Crisis in America Is (Business Insider)

- America is suffering from a student-loan debt crisis.

- While wages have increased by 67% since 1970, according to a 2018 Student Loan Hero report, college tuition has increased at an even faster rate.

American Factories Demand White-Collar Education for Blue-Collar Work (Wall Street Journal)

- Within three years, U.S. manufacturing workers with college degrees will outnumber those without.

- College-educated workers are taking over the American factory floor. New manufacturing jobs that require more advanced skills are driving up the education level of factory workers who in past generations could get by without higher education, an analysis of federal data by The Wall Street Journal found.

The Simple Reason College Tuition Costs Have Exploded (Showbiz CheatSheet)

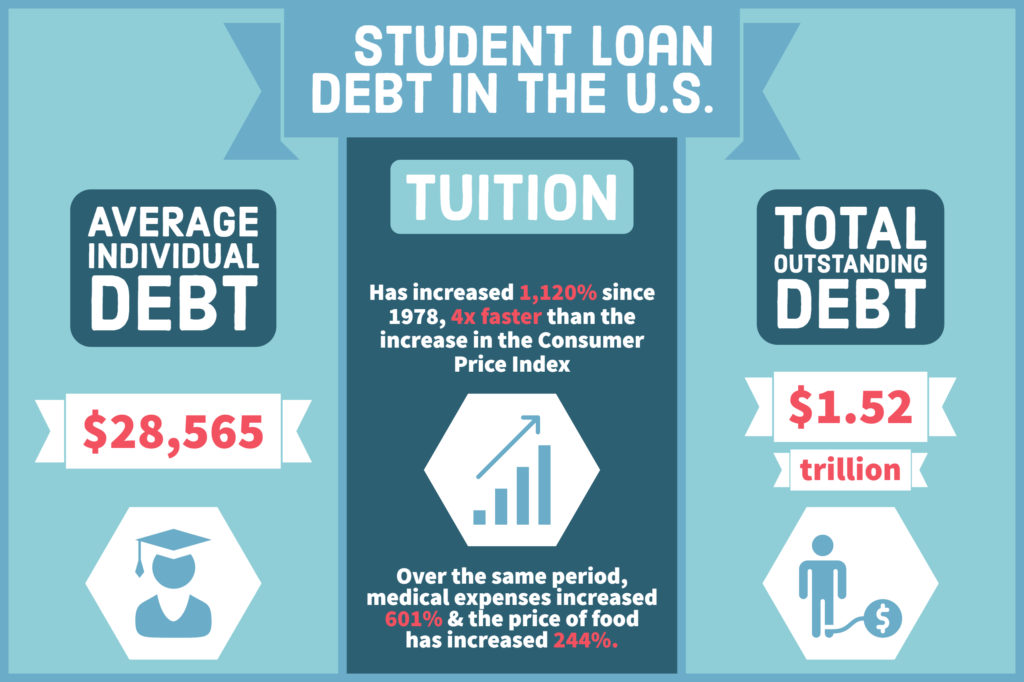

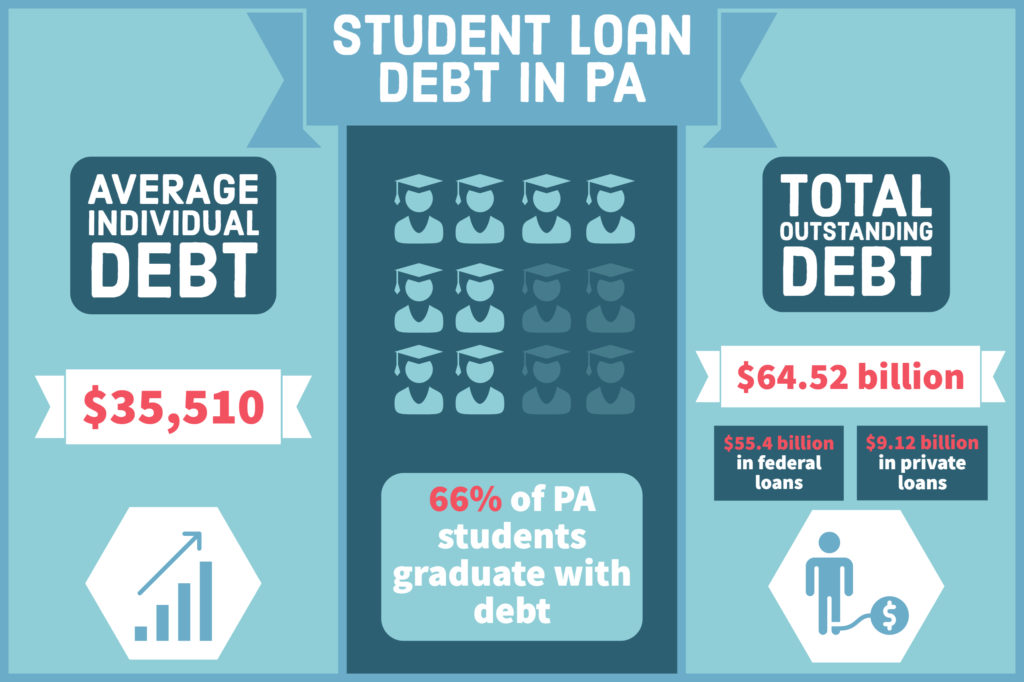

- College costs are out of control, there’s no denying it. Over the past 30 to 40 years, the price has skyrocketed 1,120%, to the point where higher education is simply unaffordable for many people, and those that do take on the financial burden are now saddled with an average of $35,000 in debt.

Average Student Loan Statistics by School by State 2019 (LendEDU)

- Nationally, outstanding student loan debt sits at $1.52 trillion, making it the second largest form of consumer debt trailing only mortgages.

Your Parents’ Financial Advice Is (Kind Of) Wrong (Wall Street Journal)

- The personal-finance playbook followed by past generations doesn’t add up for many people the way it used to. It’s time for some new money rules.

2019 is the Final Class of Millennial College Graduates. Next Stop: The Great American Affordability Crisis (Business Insider)

- Like many of their generational peers, this year’s grads are walking into an affordability crisis for young Americans. It’s triggered by several factors, including rising living costs, increasing student debt, and the ongoing fallout of the recession.

Cost of College Degree in U.S. Soars 12 Fold: Chart of the Day (Bloomberg)

- The cost of obtaining a university education in the U.S. has soared 12 fold over the past three decades, a sign the educational system is in need of reform, according to lawmakers in both parties.

Credit Supply and the Rise in College Tuition: Evidence from the Expansion in Federal Student Aid Programs (Federal Reserve Bank of New York)

- We study the link between the student credit expansion of the past fifteen years and the contemporaneous rise in college tuition.

Legislation

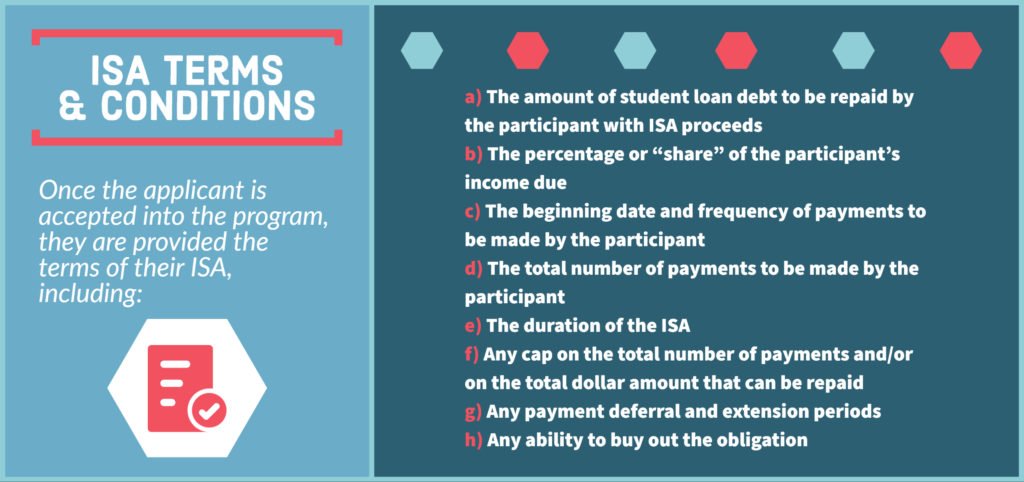

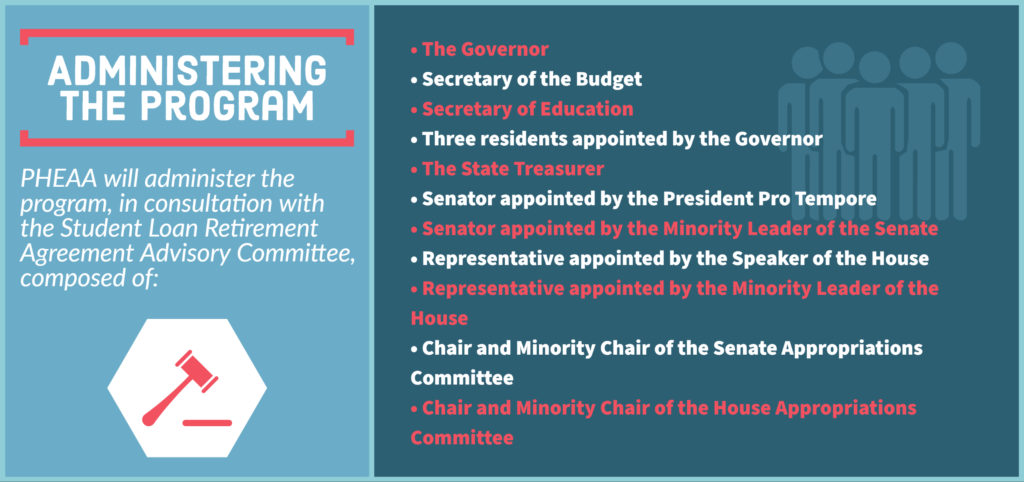

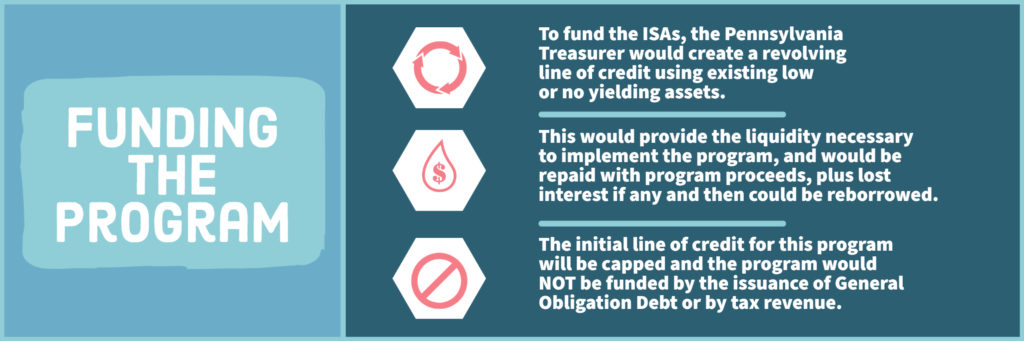

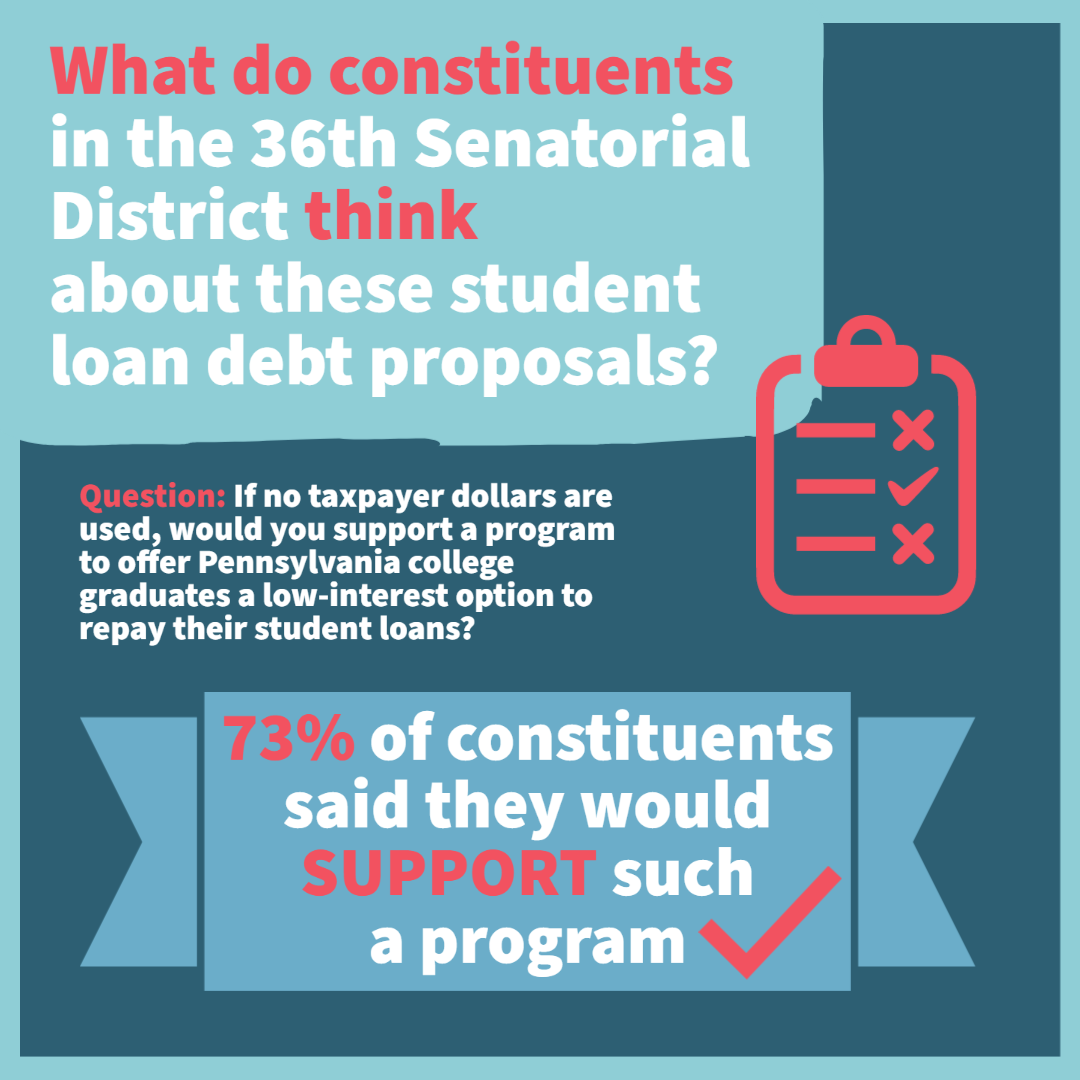

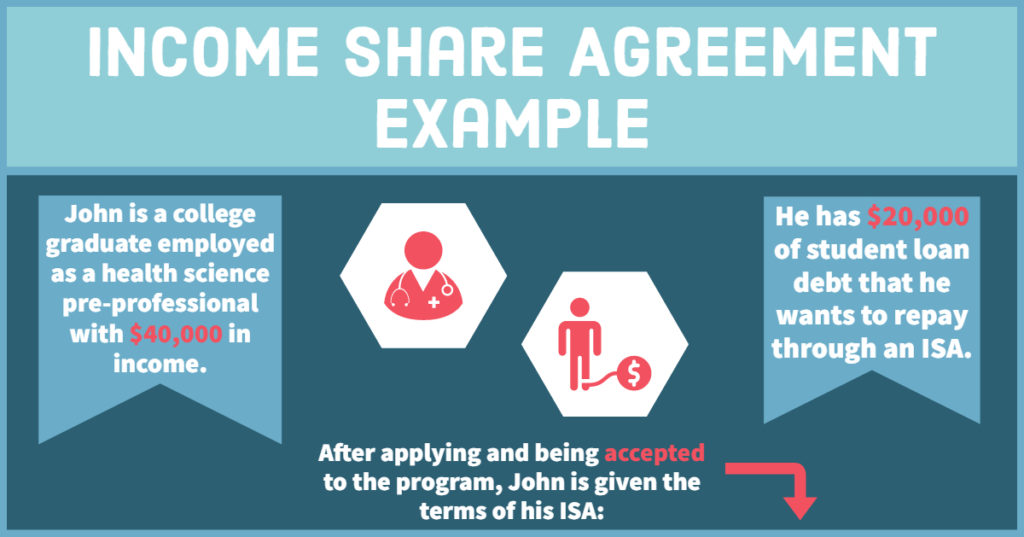

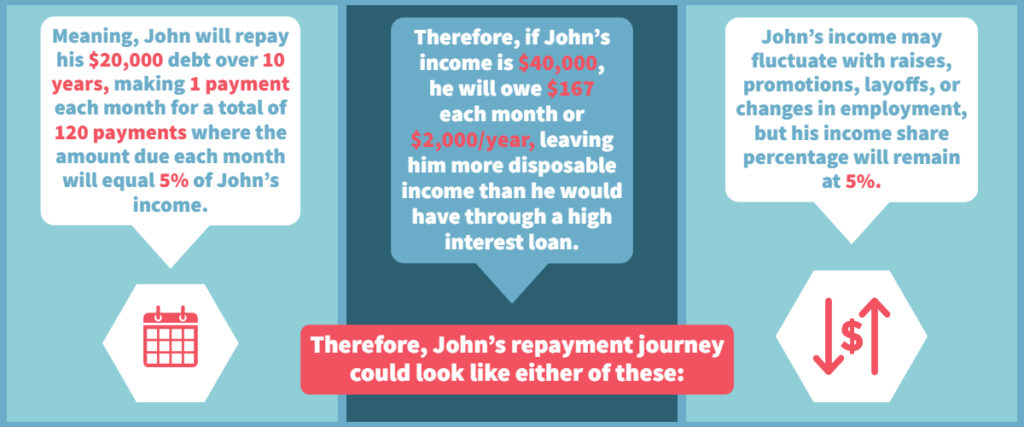

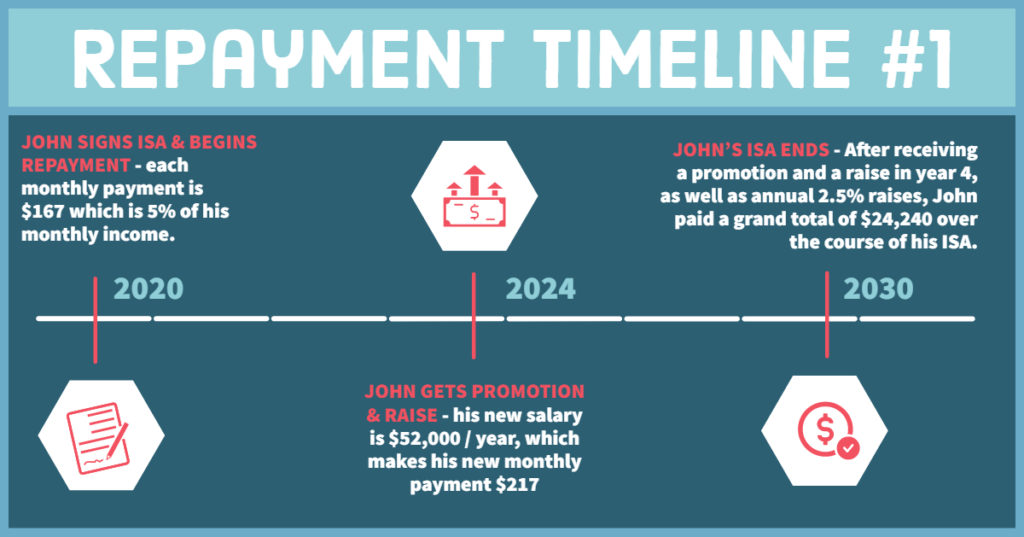

The Student Loan Retirement Agreement Program is an ISA program for graduated students that allows them to enter into a contract with the program administrator (PHEAA) where they agree to pay a fixed percentage or “share” of their income for a fixed period of time in exchange for having all or a portion of their student loans paid off.

Read the Student Loan Retirement Agreement Program bill and track it’s progress through the legislative process here.

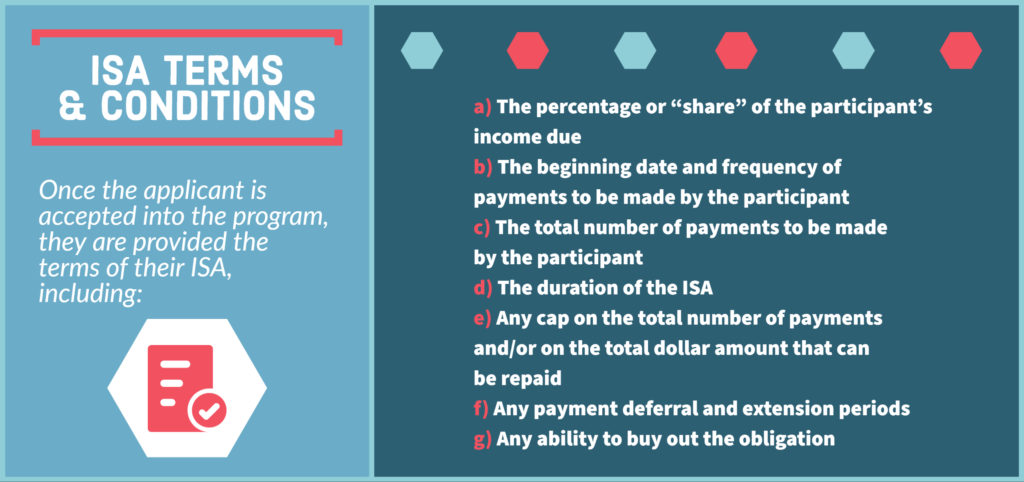

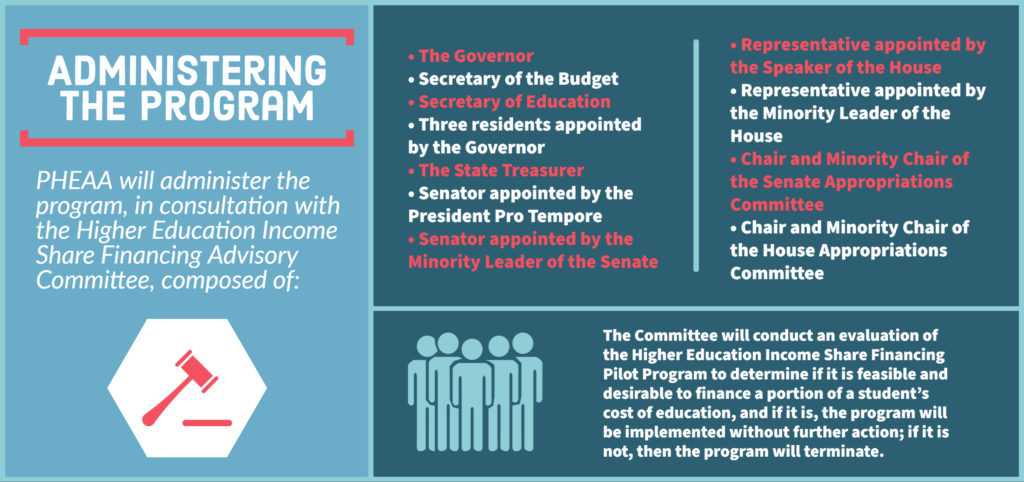

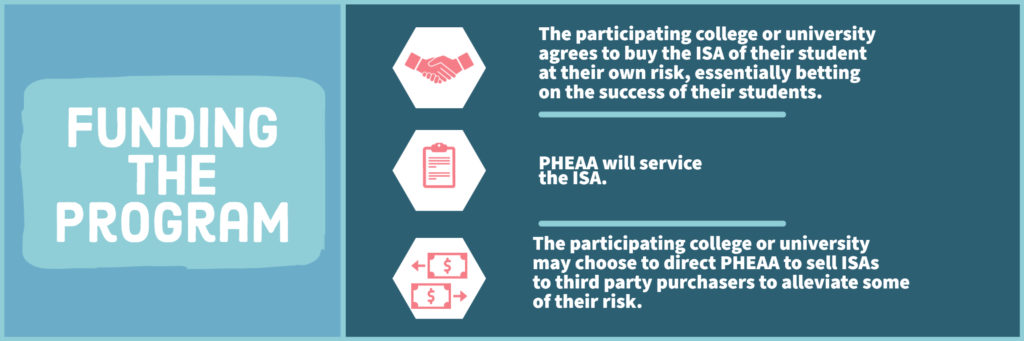

The Higher Education Income Share Financing Pilot Program is an ISA program for current students that allows them to enter into a contract with their college or university where they agree to pay a fixed percentage or “share” of their future income for a fixed period of time in exchange for having all or a portion of the cost of their education paid off.

Read the Higher Education Income Share Financing Pilot Program bill and track it’s progress through the legislative process here.

Watch Senator Aument describe his student loan debt proposals in a Facebook Live Town Hall from February 5, 2020:

News Releases

What is an Income Share Agreement?

Additional Information on the Income Share Agreements:

Start-ups Want to Turn Your Tuition Into the Next Asset Class. What Could Go Wrong? (Quartz)

- One person’s tuition is another’s investment. With US students mired in over $1.3 trillion of student debt, income-share agreements (ISA) are looking like a growth business. These contracts cover students’ tuition in exchange for a cut of their future income.

Student & Parent Perspectives on Higher Education Financing: Findings from a Nationally Representative Survey on Income-Share Agreements (American Enterprise Institute)

- Income-share agreements (ISAs) are a new higher education financing tool meant to supplement or replace student loans. With an ISA, students agree to pay a set percentage of their future income for a set number of years in return for financing for their college educations.

Should College Come With a Money-Back Guarantee? (Manhattan Institute)

- Today, costs loom large in public discussions about the problems in higher education. Tuition at four-year private colleges has grown at an average annual rate of 2.3% above inflation over the past 10 years.

Income Share Agreements: How They Work & Their Place in the Federal Regulatory Regime (Reed Smith)

- Income Share Agreements (ISAs) are a unique and innovative alternative to finance higher education. As student loan debt continues to grow, colleges and universities are offering ISAs to students in exchange for a share of the student’s future earned income.

FAQ’s

Submit Feedback

I want to hear from you!

If you have questions, comments, or feedback on my student loan debt proposals or any of the information found above, please click the button to the left.

This webpage last updated on: January 7, 2019